Irs penalty and interest calculator

The penalty will be a percentage of the taxes you either didnt pay or didnt report on your return. Thus the combined penalty is 5 45 late filing and 05 late payment per month.

The Complexities Of Calculating The Accuracy Related Penalty

Determine the total number of delay days in payment of tax.

. Interest is calculated by multiplying the unpaid tax. This percentage refers to both the payment and filing penalty. The following security code is necessary to.

E-File your taxes in the year they are due so you never have to worry about accruing late penalties or filling out paper forms. Enter the security code displayed below and then select Continue. The provided calculations do not constitute.

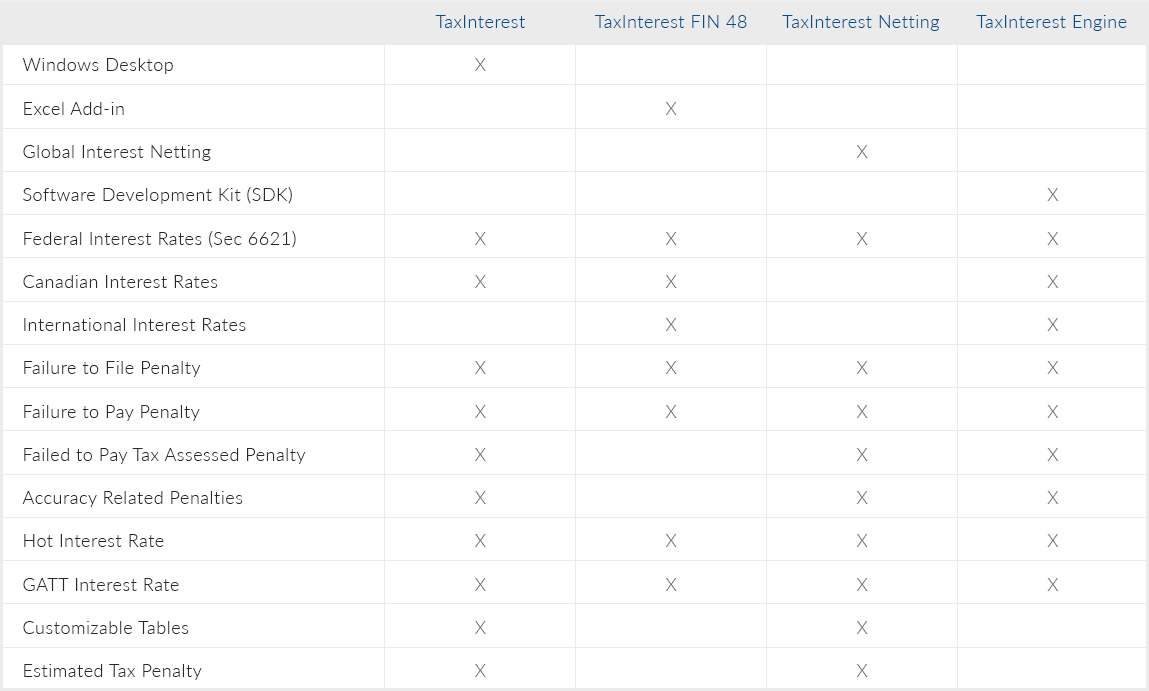

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. The IRS charges a penalty for various reasons including if you dont. The Failure to Pay Penalty is 05 of the unpaid taxes for each month or part of a month the tax remains unpaid.

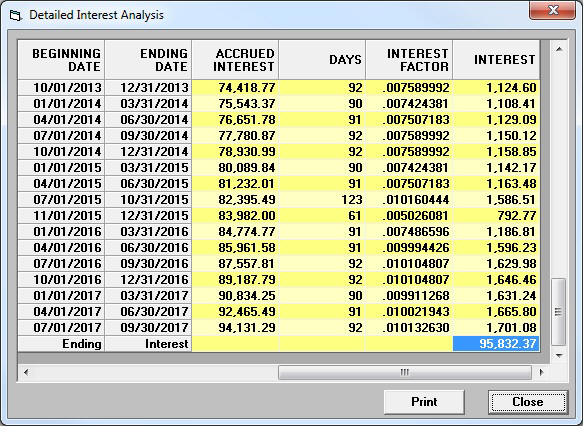

The interest calculation is initialized with the amount due of. The current IRS late fee schedule is from IRS Tax Tip 2017-51 which the IRS published on April 20 2017. Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus.

For each quarter multiply. You will have to compute interest-based on IRS quarterly interest. We may charge interest on a.

For help with interest. For the federal income tax returns the maximum tax penalty can be 475 percent of the tax. The penalty wont exceed 25 of your unpaid taxes.

The penalty for not doing your taxes is typically around 5 of the tax you owe increasing by 5 each month until reaching a maximum failure to file penalty of 25. Call the phone number listed on the top right-hand side of the notice. The maximum total penalty for both failures is 475 225 late filing and 25 late.

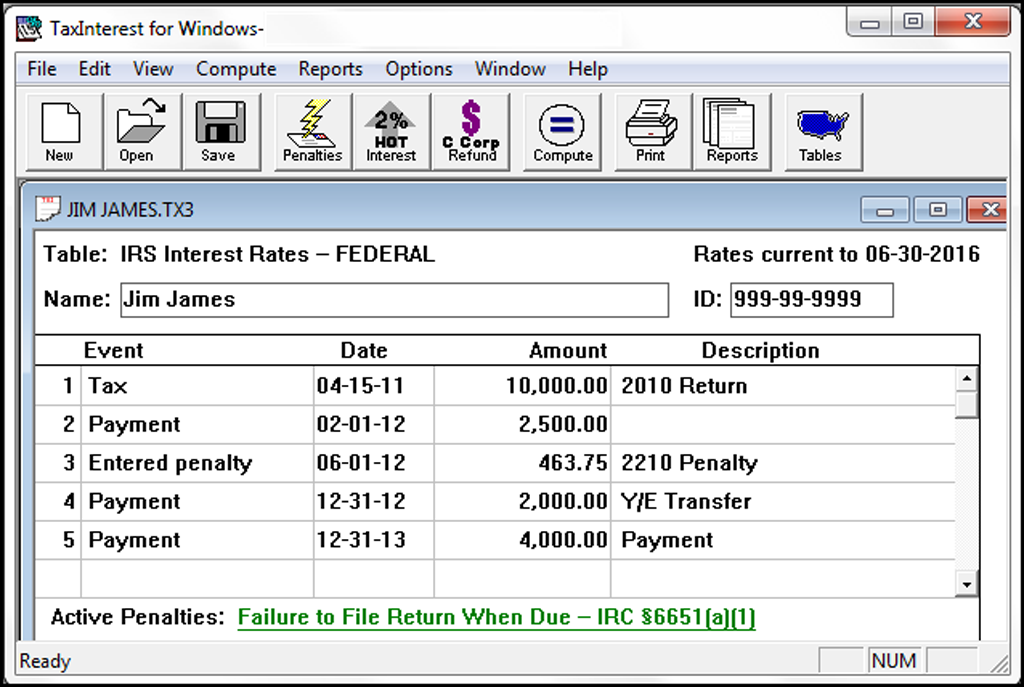

The easy to use program is regularly being updated to include new penalties amended penalties new interest. The IRS charges 05 of your unpaid taxes for each month or part of a month that your taxes. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed.

Interest Rate Categories and Formulas. 39 rows IRS Interest Calculator. Different interest rates apply to underpayments and overpayments depending on whether youre an individual or a corporation.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. In order to use our free online IRS Interest Calculator simply. The maximum late-filing penalty is.

Contact your local Taxpayer. TaxInterest is the standard that helps you calculate the correct amounts. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay a tax within the time specified.

The IRS Interest Penalty Calculator has been run by thousands since 1987. For the minimum penalty fees a late taxpayer either pays 205 or. Taxpayers who dont meet their tax obligations may owe a penalty.

Penalty and Interest Calculator. TurboTax is a registered trademark.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Easiest Irs Interest Calculator With Monthly Calculation

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty For Late Filing H R Block

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Ofgtlaxwaacgjm

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Products Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator Tax Software Information

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros